The below examples are from my recent work as a consultant with Podimo, a B2C SaaS podcasting app. At Podimo I formed the Onboarding Team which was Podimo engineering’s first time working cross functionally. The Onboarding team and it’s sister team Membership own the entire app onboarding flow and are responsible for converting users to sign-up, subscribe and launch the app. Users could subscribe either on the web or in the app but 80% of registrations were on the web. In addition to sign-ups, Onboarding was KPI’d on driving user generated growth through member get member campaigns.

Experimentation roadmap with results

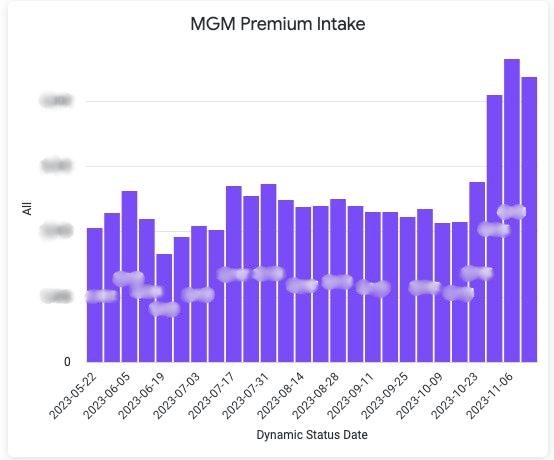

While the newborn team had a lot of technical debt to manage as it transitioned into this mission, we designated 60% of our efforts toward business goals. I identified and aligned our core KPIs, set quarterly goals and developed an experimentation roadmap that addressed both short term and long term goals. User Generated Growth (referred to as MGM or “member get member” here) was one such KPI. As a historically static metric, I honestly believed moving this metric would be hard without a significant re-think. Rather than falling into that trap, we tested some iterations to see what would happen. Tests like the this prove that we could impact this metric through simple rewards tweaks and making it more prevalent.

Results: The graph to the left shows our test campaign results which nearly doubled weekly intake on this KPI which had been static previously. We took this forward as a learning to bet on Rewards Campaigns.

Designed new Rewards Campaigns & home for Podimo app sharing

Based on our experimentation roadmap bringing us results like the above example, were were able to design out multiple experiments of a feature we in advance with data to back up the purpose. Here we have an MVP user experience of the feature plus a campaign concept that “productizes” the concept of the campaign that drove results in our earlier experiment.

The following are examples of work from the POS* Alliance** in iZettle where I’ve worked from 2016 - 2021 as the Director of Product. Our team’s charter was to create an everyday point of service, enabling small businesses to grow faster, whenever and wherever.

POS* = Point of sale - An end-to end software solution to help small businesses manage their daily sales activities and long-term planning.

Alliance** = A product area in iZettle consisting of about 130 people (14 teams).

Zettle by PayPal launched in the U.S.

After iZettle was acquired by PayPal and eventually cleared regulatory hurdles, we prepared to launch “Zettle by PayPal” in the United States. Our alliance played a major role in this effort and I’m proud to say that we launched exactly when we said we would. Not only did this ambition require the Zettle product to be localised to the U.S. with regards to partnerships, hardware, hosting, taxes, etc., but it also needed to make sense in the PayPal ecosystem. Not an easy task, a lot of this required our teams to lead the way - setting a vision (long-term vs. short-term) and managing expectations internally.

But overall, I am probably most proud of the transition Zettle made during my tenure from European payments company to a Point of Sale with global ambitions. The POS Alliance made that possible, growing from 1 team when I joined in 2016 to 14 in 2021 when launched the U.S.

Partnerships & Omni-channel

Instrumental in pivoting iZettle toward a robust partnership and omni-channel strategy and funded an area comprised of several teams in the POS Alliance specifically for this. In 2020 we launched integration / partnerships with several platforms including Shopify and BigCommerce. We quickly increased our partnerships from 3 to 20 due to this new approach.

I’ve recruited and hired a diverse number of roles in 2020 to help us to scale inbound partnerships as a priority moving forward.

Betting on Retail

Focused iZettle teams toward the objective of appealing to full-time retail businesses rather than the more general casual seller. By further engaging and retaining this group (largest active seller cohort), we expected to achieve market fit more quickly among certain personas resulting in the average payment volume per merchant to increase as well as total payment volume.

Example Gift card problems discovered:

- Work around gift card solutions (without this feature) were not compliant due to tax issues.

- iZettle’s typical in-store retail persona were more likely to make their own gift cards. But they lacked a tool to create reference numbers.

The solution was to launch a free gift card solution with barcode generator option. And partner to offer a fully integrated printed solution for more professional sellers.

Results: This focus proved key to the results of increasing average payment volume per user (above 50%).

Sell with Insights

Organising iZettle around proven core use cases

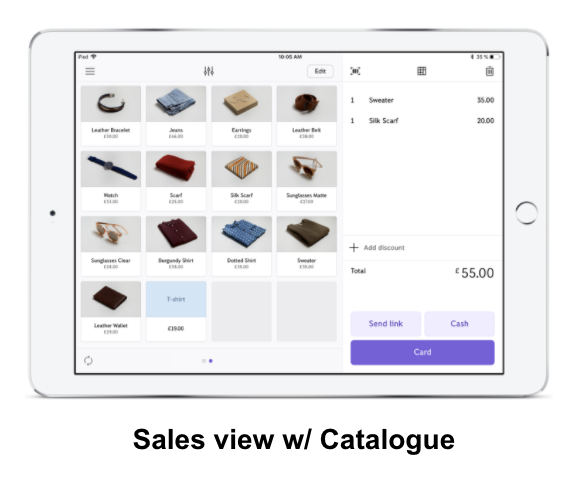

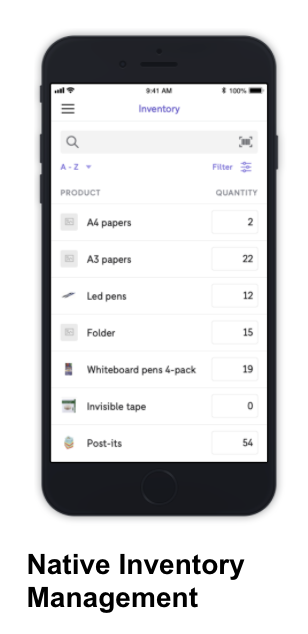

We organised teams around proven use cases of iZettle and added accountability on that level. This has enabled us to move faster and have teams collaborate more naturally around creating end user value across teams and products. Sell with insights is one such example and it’s now an Area within our POS Alliance. Any user can pick up iZettle, make sales and see helpful information… but the engagement and retention value comes when they learn that adding information into iZettle results in even better insights into running and optimising their business. Inventory, catalogue, and reporting are several teams that need to work in lock-step to really deliver on this use case.

The user insights leading to problems to solve here were many. Some examples: Average number of products <25 and median still <50. Catalogues were much larger with the variants of each product than the number of products. Inventory was done regularly sitting at home on the sofa after work. It was not just a back-office task (adding to mobile increased engagement 60%). iZettle backoffice engagement dropped significantly and no habit was forming for the majority of users who engaged 1+ times (integrated web view reporting more than doubled engagement with valuable back-office content).

The following are a few examples of my own past work leading various cross-functional teams at Spotify between 2011 - 2015. I have a wide range of experience building consumer products that millions of people use every day. I believe the best products combine the right mix of user experience, data and content to create an emotional connection with users.

Concert Discovery

The meta problem we wanted to address was “Spotify is not (yet) material to my financial stability as an artist.” To address this, we brainstormed alternative revenue streams and investigated partnerships. Concerts made up the majority of artist income. Integrating these in a personalized way would have a massive affect for artists.

Results: Within the first year, Spotify was driving between $2.5m - $5m in concerts sales for our artists. This has increased greatly since this time.

Sell your "merch" on Spotify

Addressing the same meta problem as concerts… Spotify merch was born. Presenting merchandise on Spotify to artist's fans was the first component Artists had full control over inside their artist page on the service. Whether you're a Lady Gaga fan and want your "lady fucking gaga" shirt or need your vinyl fix for Arcade Fire's latest album... you can now browse all this unique content on the service (purchases made through Topspin).

Results: Launching "merch" was a big step forward for the company toward developing significant mindshare within the music industry as a promotional vehicle (building on what we did for concerts). The success factor for us was the number of artist sign-ups. And it was a phenomenal start. Within the first 2 weeks we had 1,000 artists activate Spotify through Topspin. This feature lives on today.

Artists have full control over what merch they want to sell through Spotify.

Proxy Search (Prototyping)

The search team had a number of initiatives to make failed intents less common and successful intents even more successful. The concept of "proxy search" was developed for the latter to speak to the user need of discovery. The context is that Playlists drove the most success for our Northstar as a medium but were hardly searched. Meanwhile tracks drove the most search intents. Problem example: “It’s hard to discover quality playlists related to tracks I know and love”. Solution: insert a new curated module for certain intents.

Discover - Spotify

Discover was our first attempt at imagining what a personalised music experience could be. The lean-back discovery "magazine" concept tested as Spotify's home page for about 3 months. Users listen and follow music as signals for Discover to recommend new content such as album reviews by Rolling Stone, playlists, concerts, artists, and tastemakers. The picture to the right is from Daniel Ek's live demo in New York which I proudly attended back stage and helped rehearse. For the demo we used our new Web desktop version of Spotify to show off the magazine look & feel. Daniel followed a few of his favourite artists and at the end got a notification on his iPhone that one of them (Bruno Mars) had just released a new single. I was the PM in the team that built and shipped the user experience for desktop/mobile. From concept to large scale testing it took 6 months.

Results: Testing indicated that the global maximum potential for this product was minimal since the overall positive retention effects were within the margin of error. So, the team optimised for the local maximum (engagement, follows, etc.) and moved on. Our big learning was to focus even more on the Day 0 experience for Spotify users than building an amazing experience for existing users.

Daniel Ek, CEO of Spotify, on stage unveiling Discover for the press in December 2012. The screen shown here is about the size of a 30ft TV. Discover served up personalized recommendations based on listening and follow data.

Remember seeing lots and lots of music in your Facebook feed from what your friends were listening to? That was our team. And it worked really well.

U.S Launch of Spotify! Our team helped kick it off right. Spotify's deep integration with FB Open Graph

Our deep integration with open graph using tokenization was cutting edge and rock solid thanks to our amazing engineering team. A user clicking on a Spotify play button downloaded the app (if they didn't have it) in the background, logged the user in using their FB credentials (w/ token) and started playing music. All of this happened so fast that the user didn't need to think about it and the music was free! I joined this team as PM only 4 weeks before this initiative was shipped so I of course give them all the credit (but I didn’t sleep much either).

Results: This was a tremendous growth success increasing MAU 200% (10MM to 20MM) within the first few months of launching (from flat line growth).